Commercial space For Lease in Palisades Park, NJ

MLS# : 25011060

PROPERTY DETAILS

PROPERTY DESCRIPTION

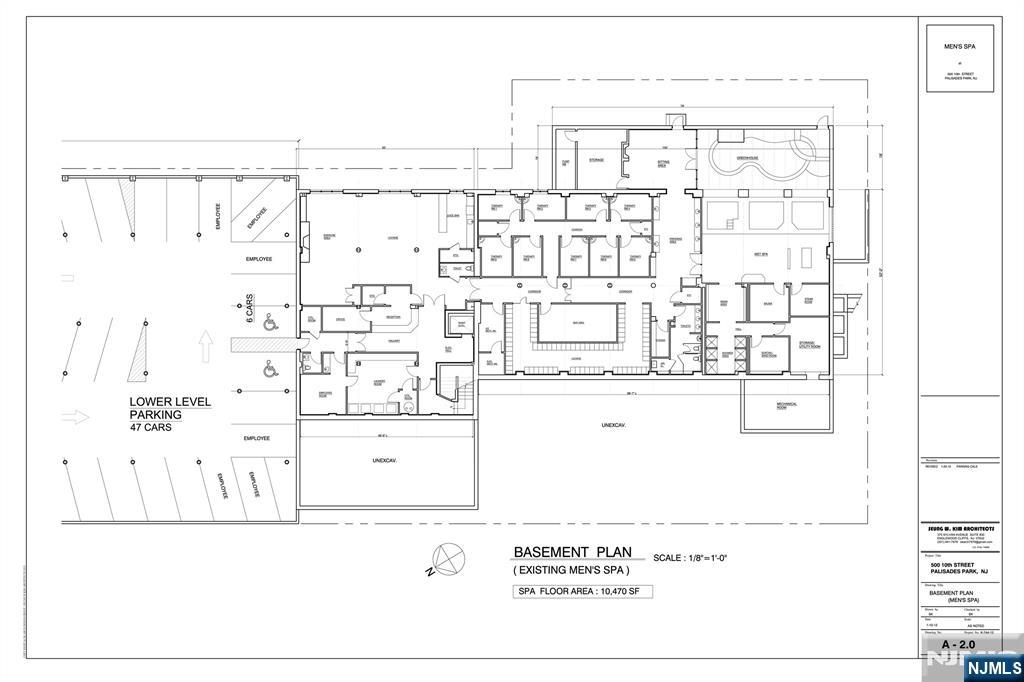

500 10th Street presents a unique opportunity to lease Apx. 10,470 sq/ft former men’s spa located in Palisades Park. Previously operated as a full-service wellness center, the property offers an expansive, thoughtfully designed layout ideal for spa, wellness, fitness, or medical use. The space includes private therapy rooms, wet spa amenities, a juice bar, and multiple lounges and relaxation areas. Support facilities such as a laundry room, employee spaces, and generous storage enhance the operational potential. The spa ceased operations during Covid and is being offered “as-isâ€Â, presenting a rare opportunity for an experienced operator to renovate and reimagine the space. Whether through minor cosmetic upgrades or a full-scale redevelopment, the property offers exceptional potential in a thriving Bergen County market.

Amenities

This listing is a courtesy of Hudson One Realty LLC

646-531-2942 office, listing agent Bora Kim

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)

About Palisades Park, NJ Real Estate Market

The foundation of Palisades Park as a modern borough got laid in 1899 under an act of the New Jersey Legislature. A few portions of Ridgefield Township got included for the formation of Palisades Park, which seeks inspiration from its location, which is at the top of New Jersey Palisades.

As said above, it is densely inhabited by Koreans, which form around 65 per cent of the total population of the borough. The borough is also known as ‘Little Korea’ and ‘Koreatown on the Hudson’ by the American natives. Even the central business district located around Broad Avenue is known as Koreatown due to the rich ethnicity of Koreans in the area. In 2015, a proposal for changing the name of Broad Avenue to ‘Korea Way’ was introduced by the Korean-American Association of Palisades Park to the mayor of the town. The influence of Korean culture is evident in this part of New Jersey real estate too.

| Population: | 19,622 |

| Total Housing Units: | 7,362 |

| Single Family Homes: | 3,547 |

| General Tax Rate (2023): | 1.479% |

| Effective Tax Rate (2023): | 1.317% |

| Compare To Other Towns |

Palisades Park Market Indicators

Similar Listings in Palisades Park

The data relating to the real estate for sale on this web site comes in part from the Internet Data Exchange Program of the NJMLS. Real estate listings held by brokerage firms other than Madison Adams are marked with the Internet Data Exchange logo and information about them includes the name of the listing brokers. Some properties listed with the participating brokers do not appear on this website at the request of the seller. Listings of brokers that do not participate in Internet Data Exchange do not appear on this website.

NJMLS is the owner of the copyrights of the listing content displayed for IDX. The NJMLS Internet Data Exchange Logo is a service mark owned by the NJMLS, Inc.

All information deemed reliable but not guaranteed. Last date updated: 04/19/2025 00:05 AM

Source: New Jersey Multiple Listing Service, Inc.

“©2025 New Jersey Multiple Listing Service, Inc. All rights reserved.”

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to compute the tax bill.

Effective Tax Rate is used to compare of one district to another district based on the assumption that all districts are at 100% valuation. This rate has been computed by the State of New Jersey Department of the Treasury using County Equalization Average Ratios. This rate is NOT to be used to compute the tax bill.

Data Source: US Census 2010, NJ MLS, State of New Jersey Department of the Treasury