Land For Sale in Weehawken, NJ

MLS# : 24020215

PROPERTY DETAILS

PROPERTY DESCRIPTION

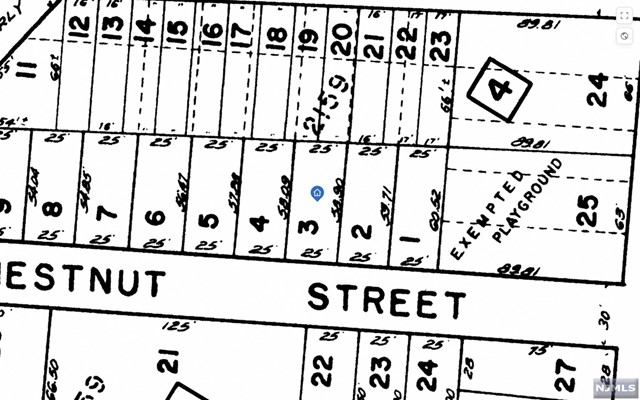

Welcome all developers to build 1-3 family homes on this cliffside lot with NYC views. 2 vacant adjoining lots sold together as a package. Zoned for 1-family, 2-family, or 3-family. NYC views from the lots Hackensack Plank Road Block 15 Lot 48 Lot size : 40 x 50 and Hackensack Plank Road Block 15 Lot 46 Lot size : 51 x 57.

Current Zoning & Permited Use

- Residntl

This listing is a courtesy of Prominent Properties Sotheby's International Realty-Hoboken

(201) 795-5200 office, listing agent Ingrid Hart

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)

About Weehawken, NJ Real Estate Market

The inspiration behind the name of the township of Weehawken evolved from the Algonquian language Lenape, which is interpreted as ‘Maize Land’ and ‘Rocks that look like trees’, with the latter indicating the Hudson Palisades.

Weehawken got established as a township in 1859 by an act of the New Jersey Legislature, including the portions of North Bergen and Hoboken. However, the actual development in the township began at the beginning of the 20th century, when many residential areas and New Jersey houses replaced the older hotels, estates and theatres. The arrival of European inhabitants further resulted in the development of real estate in this part of Hudson County. In the 20th century, Weehawken became a hub for embroidery factories while remaining a residential township to a large extent.

| Population: | 15,125 |

| Total Housing Units: | 6,804 |

| Single Family Homes: | 1,959 |

| Apartments: | 4,845 |

| General Tax Rate (2023): | 1.676% |

| Effective Tax Rate (2023): | 1.802% |

| Compare To Other Towns |

Weehawken Market Indicators

PRICE INDEX

| Average Price* (12mo): | $876,955 |

| Apatments Sold* (12mo): | 64 |

The data relating to the real estate for sale on this web site comes in part from the Internet Data Exchange Program of the NJMLS. Real estate listings held by brokerage firms other than Madison Adams are marked with the Internet Data Exchange logo and information about them includes the name of the listing brokers. Some properties listed with the participating brokers do not appear on this website at the request of the seller. Listings of brokers that do not participate in Internet Data Exchange do not appear on this website.

NJMLS is the owner of the copyrights of the listing content displayed for IDX. The NJMLS Internet Data Exchange Logo is a service mark owned by the NJMLS, Inc.

All information deemed reliable but not guaranteed. Last date updated: 11/21/2024 00:05 AM

Source: New Jersey Multiple Listing Service, Inc.

“©2024 New Jersey Multiple Listing Service, Inc. All rights reserved.”

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to compute the tax bill.

Effective Tax Rate is used to compare of one district to another district based on the assumption that all districts are at 100% valuation. This rate has been computed by the State of New Jersey Department of the Treasury using County Equalization Average Ratios. This rate is NOT to be used to compute the tax bill.

Data Source: US Census 2010, NJ MLS, State of New Jersey Department of the Treasury