The Borough of Saddle River has been successful in offering its residents the second lowest real estate tax rate in Bergen County. The low tax rate has resulted in sustained higher property values, despite the fact that the NJ State legislature has adopted crushing regulatory burdens and other financial restraints on property owners with little regard to property rights or the State economy.

Real estate taxes levied and the manner in which they are calculated in New Jersey is a special kind of marvel. When you want less of something, tax it! In an inverse correlation, property values diminish with the rise of property taxes creating a lower demand for housing and investment. Properties with higher taxes have always been less attractive to any rational buyer.

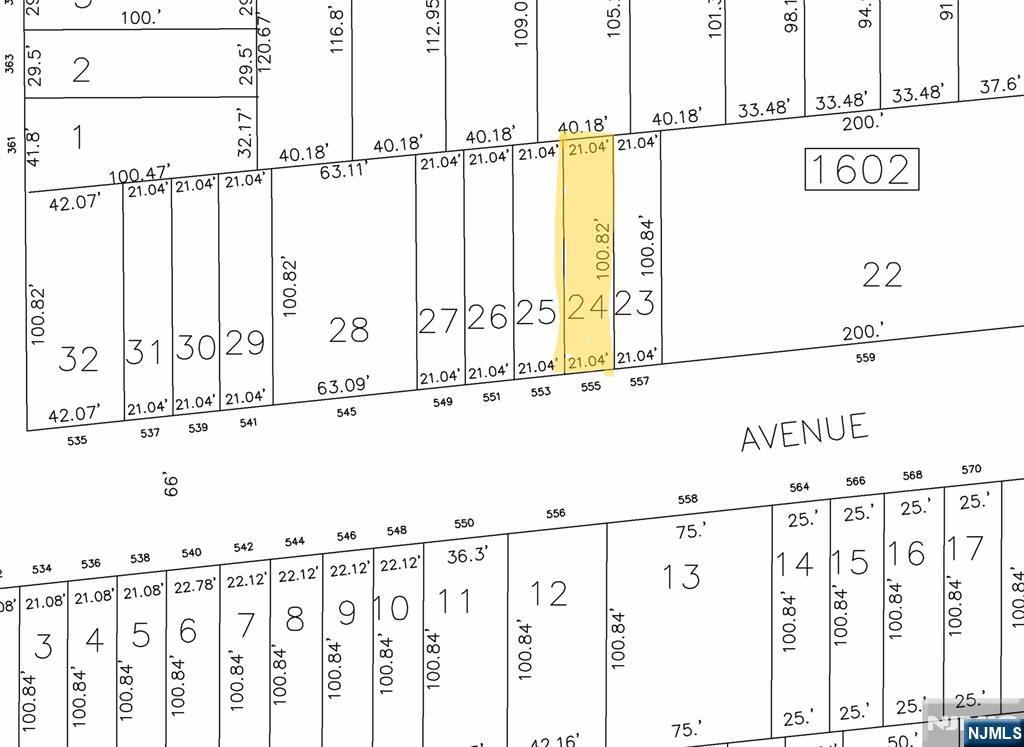

Real estate property tax in NJ is calculated based on a tax rate set by the NJ State bureaucracy and a periodic assessment of a property value performed by a government contractor. The assessment is based on the recent sales of similar properties in the vicinity within a specified period of time for comparison.

The calculation is based on two factors: the assessment of land and improvement, i.e. building or a house.

Land assessment, in general, is more uniform and consistent among properties. The main factors affecting land assessment are the size of a property, topography and its best use under the existing zoning restrictions and environmental regulations. This assessment is relatively straightforward and tangible.

On the other hand, the assessment of an improvement may vary tremendously from one property to another. It is calculated using a progressive scale based on factors such as the square footage, number of bedrooms, bathrooms, basement conditions, existing updates and the quality of the finishings. This progressive methodology forces a property owner with a larger or updated house to carry a higher tax burden than his neighbor with little or no difference to the services provided to both residents living in the same municipality.

This tax burden distribution or so called “fair share” is far from being fair or moral. It can be traced directly to Karl Marx Communist Manifesto which dictates that those with their ability must provide to those with their need while bureaucrats are in charge of the process. In other words, under the existing property tax code, success is being punished and mediocracy rewarded which stifles growth and destroys the economy.

Except the times when a property is being assessed, there is very little correlation between the assessed value and market value. The primary reason is the fact that the market value is continuously changing with the market sentiment and the assessed value is generally constant during the period between the assessment intervals.

There are two different property tax rates - one to calculate the tax bill and the other used to compare one municipality to another.

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to calculate the tax bill. For example, if the current 2018 tax rate in Saddle River is 0.906% and a property assessment is at $1,000,000 the tax bill would be $9,060 for that particular year.

Effective Tax Rate is used to compare one municipality to another based on the assumption that all municipalities are at 100% valuation. This rate is calculated by the State of New Jersey Department of the Treasury using County equalization average ratios. This rate is not to be used to calculate the tax bill.

The bottom line is that low property tax is one of the main reasons that attract buyers and investors to Saddle River making it the best town to live in Bergen County.

Bergen County Tax Rates by Town - CLICK HERE

Hudson County Tax Rates by Town - CLICK HERE

.jpg)